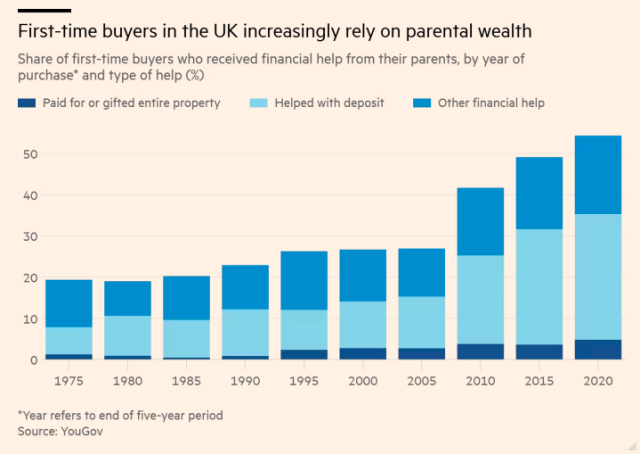

A reminder that while the 'Bank of Mum & Dad' seems like benign help parents can give their children, its actually one of the key mechanisms (alongside under-taxed inheritance) that maintains inequality in the UK.

Now, over 50% of first time buyers rely on their parents to help them get on the wealth escalator that is the UK's dysfunctional housing market.

On an individual level parental help is clearly understandable, on a social level its actually a problem!

Panicz Maciej Godek

in reply to Emeritus Prof Christopher May • • •Emeritus Prof Christopher May

in reply to Panicz Maciej Godek • • •Tim Ward ⭐🇪🇺🔶 #FBPE

in reply to Emeritus Prof Christopher May • • •Once Upon A Time mortgages were regulated and limited to three times salary.

Guess what houses cost then? Yup, you've got it, three times salary.